McLennan Protests Save $1.24 Billion in Taxable Value

O'Connor discusses how McLennan County protests saved $1.24 billion in taxable value in 2025.

WACO, TX, UNITED STATES, October 27, 2025 /EINPresswire.com/ --With Waco at its heart, McLennan County acts as a central point for countless smaller communities. Often acting as the big city for rural towns, McLennan County provides medical care, jobs, and services that the surrounding area cannot provide for themselves. This has made the county quite vibrant and one that captures the true spirit of Texas like no other. Serving as the central hub for the area means that McLennan County also has the most valuable land in the region, with only nearby Bell County being a rival. Like most Texas counties, McLennan has seen its taxable property value double in the past decade, with both homes and businesses seeing higher tax bills every year.

Property tax appeals are becoming the go-to way to lower levies across the state. While exemptions are a great first step, it is these protests that can really make the difference, though they are often ignored. McLennan County had decent participation in the appeal process, with over 15% of properties being appealed in 2023, which is better than the state average. This is due to both the education of the populace and thanks to aggressive taxation by the McLennan Central Appraisal District (MCAD). As tax rates and values continue to climb, so will appeals. In this article, we will see how the appeals process played out in 2025 and what effect it had for homes and businesses.

McLennan Residential Property Tax Appeals Almost Eliminate Hikes

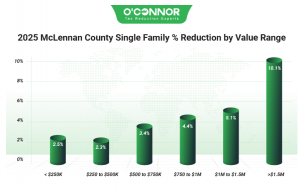

MCAD initially raised total home taxable value by 3.5%, resulting in a sum of $23.24 billion. MCAD also estimated that 28% of all homes were overvalued. This motivated homeowners across the county to protest their taxes, using both informal and formal appeals to the appraisal review board (ARB). While informal appeals achieved little, ARB hearings lit a fire, which eventually resulted in a total reduction of 3%. This pushed the total value down to $22.53 billion, almost erasing the gain entirely. The largest block of residential value was homes worth between $250,000 and $500,000, which totaled $10.43 billion after a reduction of 2.3%. Following a cut of 2.5%, homes assessed at under $250,000 totaled $5.47 billion. Homes between $500,000 and $750,000 were reduced by 3.4% to $3.65 billion, while those worth $750,000 to $1 million dropped 4.4% to $1.42 billion. O’Connor clients saw a residential taxable value total reduction of 6.1%.

While a growing community, McLennan County generally shied away from mansions or luxury homes. Most were modest, reflecting a traditional Texan way of life. Following a reduction of 2.5%, homes under 2,000 square feet dropped to $11.03 billion, mostly countering an increase of 3.6%. Homes between 2,000 and 3,999 square feet had previously experienced an increase of 2.7%, but these were able to land a reduction of 3%, wiping out the increase and falling to $9.98 billion. Massive homes, while rare, saw one of the best reversals of fortune. Originally, these luxury residences increased by 8.9%; however, they then experienced a giant decrease of 13.3%, achieving a total of $151.01 million.

Residential properties in McLennan are generally older than many other counties, but there is a bit of a boom in new construction as well. The largest category of value was homes constructed between 2001 and 2020, which totaled $6.89 billion after a reduction of 3.2%. These had previously been increased by just 1%, so this was a successful cut. Homes built before 1960 and those between 1981 and 2000 each contributed around $4.90 billion, which was achieved after reductions of 3% and 2.5% respectively. New construction had initially soared with an increase of 21.7%, but this was slowed with a reduction of 4%, resulting in a final tally of $1.76 billion.

Massive Barrage of Property Tax Appeals Saves Over $557 Million in Commercial Value

In 2025, commercial property owners received word that they would be receiving increases, which resulted in the total value of businesses in the county growing by 6.9% to $13.05 billion. As businesses usually appeal much more aggressively, especially with ARB hearings, this was quickly counterbalanced with a decrease of 4.3%, dropping the new total to $12.49 billion. The main source of value and the primary reason for the overall drop was commercial properties worth over $5 million. These had originally increased by 11.6%, reaching a total of $7.06 billion. This was protested and reduced by 4.9%, for a new total of $6.72 billion. Properties worth between $1 million and $5 million got a cut of 5.4%, reaching a final figure of $2.87 billion, which erased an increase of 2.8%. We at O’Connor managed to save our clients 10.1% in total taxable value, including 10.9% for properties over $5 million.

Anyone who has seen the expansive nature of McLennan County would guess that the most valuable property is undeveloped land, and they would be right. Raw land accounted for $4.80 billion, though it did not see any decreases of note. Offices were in second place with $2.37 billion after a reduction of 2.6%, partially countering an increase of 4.2%. Apartments saw a giant jump in value of 18.7%, which was eventually lowered 16.3% to $1.98 billion, a major success story. Retail and warehouses each got reductions of 6.1%, reaching totals of $1.24 billion and $1.62 billion respectively. Hotels had jumped 24% in 2025, following a trend in the state, but were knocked down 15.2%, which resulted in a final sum of $488.90 million.

As with homes, commercial properties saw the largest chunk of their value constructed from 2001 to 2020, resulting in a total of $3.02 billion after a cut of 12.5%. This had previously been raised 14.2%, so these about evened out. Commercial properties from 1981 to 2020 dropped by 7.3%, receiving a total of $1.31 billion. Initially being handed an increase of 3.5% by MCAD in 2025, properties built from 1961 to 1980 managed to land a reduction of 5.7%, which overwhelmed the increase and produced a final figure of $1.35 billion. New construction leaped 25.3% in value, but the total of $707. 53 million was eventually reduced by 3.7% to $681.29 million.

Offices Serve as a Perfect Illustration for the Power of Appeals

While there were many commercial property types in McLennan County, the most valuable outside of raw land was offices. After MCAD assessed a 4.2% increase, targeted appeals successfully reduced the total by 2.6%, bringing the final amount to $2.37 billion. In an anomaly for properties across the county, construction from 1981 to 2000 was the No. 1 source of office value, achieving $702.88 million following a reduction of 2.1%. The traditional frontrunner, offices built between 2001 and 2020 saw a reduction of 3.8%, resulting in $654.88 million. These two timeframes had seen increases of 2.3% and 6% respectively. Offices built between 1961 and 1980 only increased by 1.5%, but saw a decrease of 2.1%, reaching $553.67 million. New construction, predictably, flew high with an initial jump of 48%, before being wrangled with a cut of 3.3%. This brought them a final figure of $90.70 million. O’Connor clients saved even more on their office properties, achieving a reduction of 9.1%, including a giant slash of 15.8% for those built from 2001 to 2020.

MCAD only used three subtypes for offices. Low-rise offices dominated by a total of $2.14 billion, which was made possible by a reduction of 2.2%. High-rise buildings managed a solid cut of 5.8%, achieving a total of $217.48 million. The final category was medical offices, which got a reduction of 5.9%, for a small total of $2.35 million.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.